01Dec

What to do before signing your car insurance contract?

Choosing the right car insurance is a major challenge for any driver. From comparing prices to understanding the various packages offered, every detail must be taken into account. Whether you are a young driver, an experienced driver or an avid collector of classic cars, you have your own needs in terms of car insurance. Let’s learn more about this in our article! Third party insurance is the compulsory minimum insurance formula. It covers damage you could cause to others, but not damage you could suffer. It is often recommended for used or low value vehicles. All-risk insurance, quant à elle, offre une couverture plus large. Elle inclut la garantie dommage tous accidents qui vous couvre même en cas d’accident responsable. Souvent préférée pour les véhicules neufs ou de grande valeur, elle est plus coûteuse que l’assurance au tiers. Il est essentiel d’évaluer plusieurs facteurs avant de faire votre choix, tels que la valeur de votre véhicule, votre budget, votre tolérance au risque et votre style de conduite. N’oubliez pas que ces deux contrats d’assurance ne sont pas les seuls et qu’il en existe bien d’autres, peut-être davantage adaptés à vos besoins !

Realize the importance of this contract

The importance of car insurance goes beyond simple legality. Indeed, it plays a crucial role in the event of a disaster, providing financial protection against property damage or bodily injury, whether you are responsible or not. It can cover the cost of repairing your vehicle, towing and even medical expenses following an accident. The fact that claims handled par votre assureur ne soient pas à régler de votre propre poche est un avantage financier remarquable. De plus, en cas de vol ou de vandalisme, l’assurance auto peut vous indemniser, minimisant ainsi les pertes financières. Elle offre aussi une protection juridique, prenant en charge les frais de défense en cas de litige suite à un accident. En somme, une assurance auto est un outil de gestion des risques et un garant de tranquillité d’esprit sur la route. Vous devez absolument vous en prémunir pour respecter la loi mais également pour bénéficier d’une sécurité financière qui n’a pas de prix.Follow certain steps

Pour souscrire une assurance auto, il faut suivre plusieurs étapes. D’abord, rassemblez les documents nécessaires. Ceux-ci comprennent votre certificat d’immatriculation, votre permis de conduire et votre relevé d’information. Ensuite, comparez les offres d’assurance disponibles. Vous pouvez le faire en ligne ou avec l’aide d’un courtier en assurance. Considérez les caractéristiques du contrat d’assurance, notamment le niveau de couverture, les franchises et les options proposées. Une fois que vous avez choisi l’offre qui vous convient le mieux, vous pouvez souscrire le contrat. Cela peut généralement être fait en ligne ou par téléphone. Veillez à bien lire et comprendre les termes du contrat avant de souscrire.Analyze your vehicle type

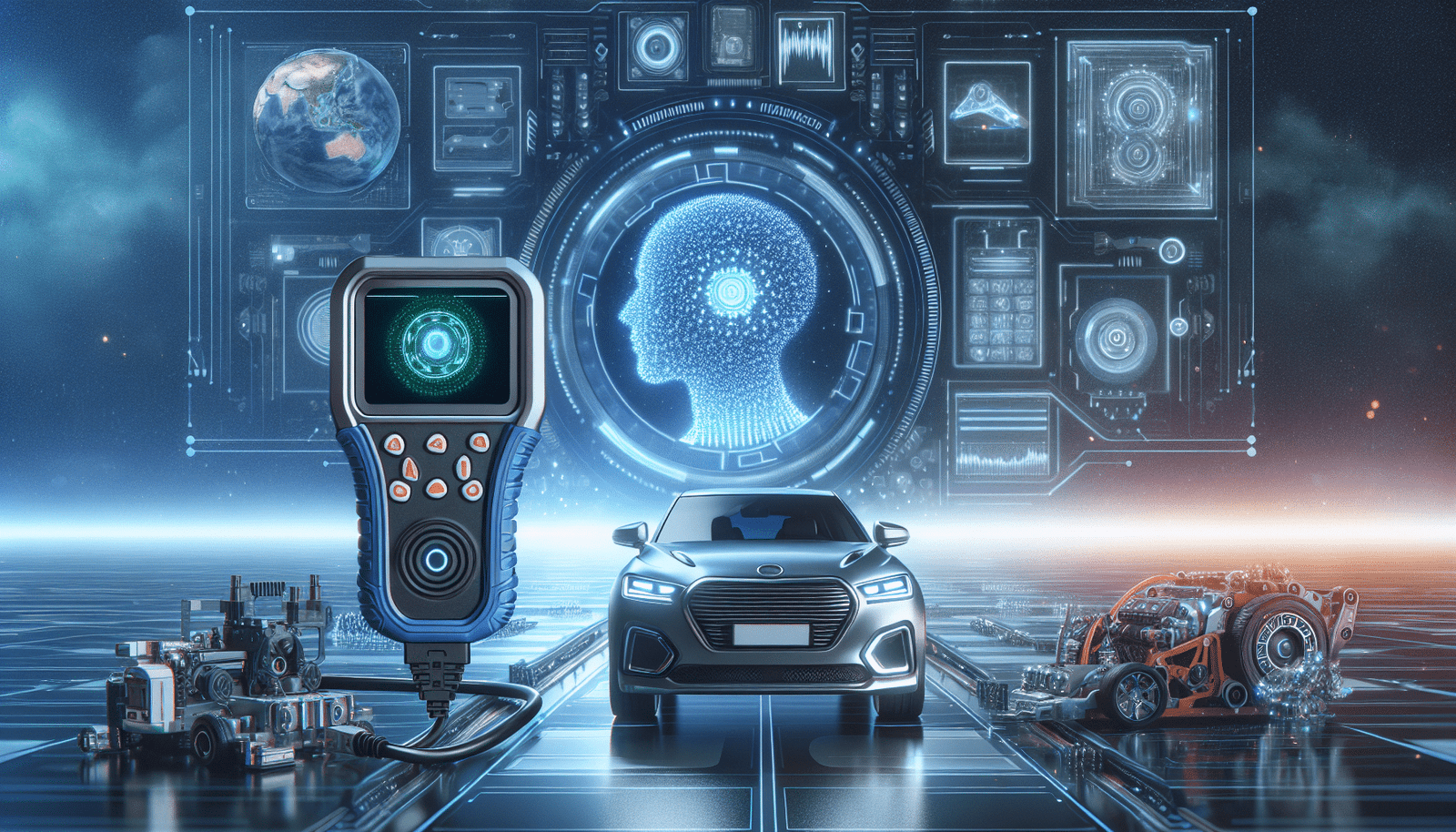

Selon le type de véhicule que vous possédez, le choix de votre assurance peut varier. Les véhicules neufs ou haut de gamme sont souvent mieux protégés avec une assurance tous risques, tandis qu’une assurance au tiers peut suffire pour un véhicule d’occasion ou de faible valeur. Les voitures électriques nécessitent une couverture spécifique, intégrant les risques liés à la batterie. De même, les voitures puissantes ou sportives peuvent engendrer une prime plus élevée du fait du risque d’accident plus élevé. Enfin, n’oubliez pas que certains véhicules spécifiques comme les véhicules de collection ou les camping-cars nécessitent des assurances spécifiques.Choosing the right car insurance

Parmi les principaux types de contrats d’assurance, nous retrouvons en haut du podium l’assurance au tiers et l’assurance tous risques. Le choix entre l’assurance tous risques ou au tiers dépend largement de votre situation personnelle et de vos besoins en matière de couverture :Use an online comparator

L’utilisation d’un comparateur en ligne pour choisir votre assurance auto présente plusieurs avantages. Tout d’abord, il vous permet de gagner du temps. Au lieu de visiter chaque site d’assureur et de remplir plusieurs fois les mêmes informations, vous n’avez qu’à entrer vos données une seule fois sur le comparateur. Par la suite, celui-ci se charge de vous présenter les offres qui correspondent à votre profil et à vos besoins. Le comparateur en ligne offre également une transparence des prix. Vous pouvez ainsi comparer les tarifs de plusieurs assureurs en un coup d’œil, et faire un choix éclairé en fonction de votre budget. Enfin, le comparateur en ligne vous permet de prendre connaissance des détails des contrats proposés par les différents assureurs, tels que les montants des franchises, le niveau de couverture ou encore les options souscrites. —————- We hope to have given you all the necessary information about car insurance so that you can choose it best. This is an important contract that should not be taken lightly, so take the time to select the one that meets your needs!Latest posts by SB - OBD Diag (see all)

Leave a Reply